Yo, check it out! We’re diving into some key debt management tips to help you level up your financial game. From boosting your credit score to reducing debt, we’ve got the inside scoop on how to take control of your money like a boss. So, let’s get started!

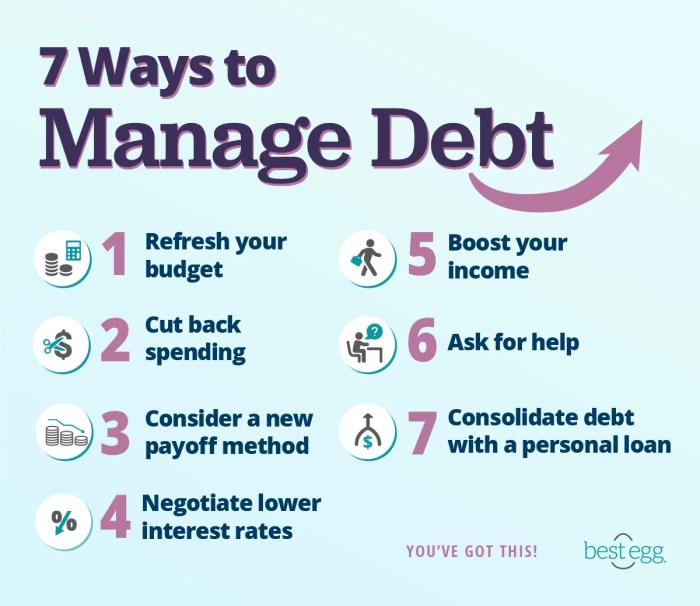

When it comes to managing your finances, having a solid plan in place is crucial. Debt management tips offer practical strategies to help you navigate through the world of money management with confidence and ease.

Importance of Debt Management

Debt management plays a crucial role in achieving financial stability. It involves creating a plan to effectively handle and repay debts, ultimately leading to a healthier financial situation.

Improving Credit Scores, Debt management tips

Effective debt management can significantly boost credit scores. By making timely payments and reducing overall debt, individuals can demonstrate financial responsibility to creditors, leading to an increase in credit scores over time.

Avoiding Financial Distress

Poor debt management, on the other hand, can quickly spiral into financial distress. Missing payments, accumulating high-interest debt, and maxing out credit cards are all examples of how mismanaging debt can lead to a cycle of financial instability and stress.

Creating a Budget: Debt Management Tips

When it comes to managing debt effectively, creating a budget is key. A budget helps you track your income and expenses, allowing you to allocate funds towards debt repayment while still covering your essential needs.

Steps to Create a Monthly Budget

- List all sources of income: Start by identifying all the money you receive each month, including salaries, bonuses, and any other forms of income.

- Track your expenses: Keep a record of all your expenses, from bills to groceries to entertainment. This will give you a clear picture of where your money is going.

- Differentiate between needs and wants: Prioritize essential expenses like rent, utilities, and groceries before allocating money towards discretionary spending.

- Set debt repayment goals: Determine how much you can afford to put towards debt repayment each month and make it a priority in your budget.

- Adjust as needed: Regularly review and adjust your budget to ensure you are staying on track with your debt repayment goals.

Importance of Tracking Expenses in a Budget

Tracking your expenses is crucial in a budget as it helps you identify areas where you can cut back and save more money for debt repayment. By knowing where your money is going, you can make informed decisions on how to allocate funds more effectively.

Tips to Adjust a Budget for Debt Repayment

- Reduce non-essential spending: Cut back on unnecessary expenses like dining out, shopping, or subscription services to free up more money for debt repayment.

- Increase income: Consider taking on a part-time job or selling items you no longer need to boost your income and accelerate debt repayment.

- Negotiate lower interest rates: Contact your creditors to see if you can lower the interest rates on your debts, reducing the overall amount you need to repay.

- Automate payments: Set up automatic payments for your debts to ensure you never miss a payment and incur additional fees or interest.

Strategies for Debt Reduction

When it comes to reducing debt, there are several strategies that can help individuals take control of their financial situation and work towards becoming debt-free. Two popular methods are the snowball method and the avalanche method, each with its own benefits and considerations.

Snowball Method

The snowball method is a debt reduction strategy where you focus on paying off your smallest debts first, while making minimum payments on larger debts. Once the smallest debt is paid off, you roll that payment into the next smallest debt, creating a “snowball” effect that accelerates your debt payoff. This method can provide a sense of accomplishment and motivation as you see debts being eliminated one by one.

Avalanche Method

The avalanche method involves tackling debts with the highest interest rates first, while continuing to make minimum payments on other debts. By focusing on high-interest debts, you can save money on interest payments over time and pay off your debts faster. While this method may not provide the immediate gratification of the snowball method, it can result in significant interest savings in the long run.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan or line of credit with a lower interest rate. This can make it easier to manage debt by simplifying payments and potentially reducing overall interest costs. However, it’s important to carefully consider the terms and fees associated with debt consolidation, as well as the impact on your credit score.

Avoiding Accumulation of New Debt

To maintain financial stability and avoid falling deeper into debt, it is crucial to resist the temptation of taking on new debts. Building an emergency fund can serve as a safety net during unexpected expenses and prevent the need for additional borrowing. It is also essential to distinguish between necessary and unnecessary expenses to prioritize financial health.

Resisting Temptation of New Debt

- Avoid impulse purchases by creating a shopping list and sticking to it when shopping.

- Avoid opening new credit cards unless absolutely necessary to prevent accumulating more debt.

- Consider delaying major purchases until you have saved enough money to pay in full.

Building an Emergency Fund

- Set aside a portion of your income each month to build your emergency fund gradually.

- Ensure your emergency fund can cover at least three to six months’ worth of living expenses.

- Use high-interest savings accounts or money market accounts to maximize the growth of your emergency fund.

Distinguishing Between Necessary and Unnecessary Expenses

- Prioritize essential expenses such as housing, utilities, and groceries over discretionary spending.

- Avoid spending on luxury items or non-essential services that can contribute to new debt.

- Track your expenses and identify areas where you can cut back to save money and avoid unnecessary debt.

Seeking Professional Help

When managing debt becomes overwhelming or you feel stuck in a cycle of financial stress, it may be time to seek help from credit counselors or financial advisors. These professionals can provide expert guidance and support to help you navigate your way out of debt.

Benefits of Debt Management Programs

- Consolidation of multiple debts into one manageable monthly payment.

- Negotiation with creditors to lower interest rates or waive fees.

- Structured repayment plans tailored to your financial situation.

- Financial education and tools to help you build better money management habits.

Choosing a Reputable Debt Management Service

Look for accredited agencies with certified counselors who have a track record of success in helping clients reduce debt.

- Check for any complaints or disciplinary actions against the agency with the Better Business Bureau or state consumer protection office.

- Avoid services that charge high upfront fees or promise quick fixes that sound too good to be true.

- Ensure the agency is transparent about their fees, services, and how they will work with you to achieve your financial goals.

- Get recommendations from trusted sources or financial professionals before committing to a debt management program.