Best indicators for day trading are like the cool tools that help you rock the stock market. Let’s dive into the world of indicators and discover how they can make or break your day trading game.

From types of indicators to moving averages and oscillator indicators, we’ve got the lowdown on what you need to know to slay the day trading scene.

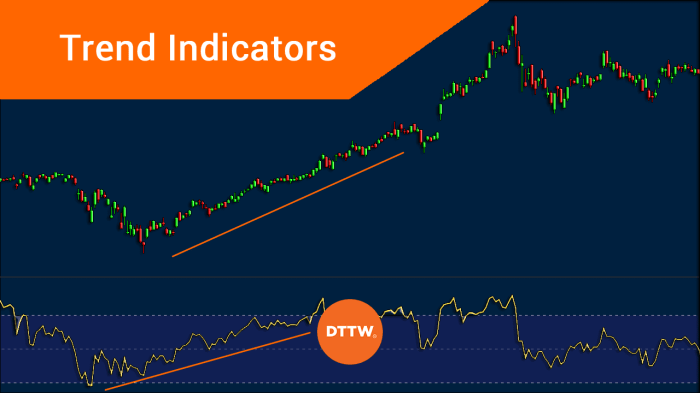

Types of Indicators

When it comes to day trading, there are various types of indicators that traders use to analyze price movements and make informed decisions. These indicators can be broadly categorized into leading indicators and lagging indicators. Leading indicators signal potential changes in price direction before they occur, while lagging indicators confirm trends that have already started. Let’s explore some popular indicators in day trading:

Moving Averages

Moving averages are one of the most commonly used indicators in day trading. They smooth out price data to create a single flowing line, making it easier to identify trends. Traders often use the crossover of different moving averages to signal potential buy or sell opportunities.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in the market.

Bollinger Bands, Best indicators for day trading

Bollinger Bands consist of a simple moving average and two standard deviations plotted above and below the moving average. They help traders identify volatility and potential reversal points in the market.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders look for MACD line crossovers to signal changes in the direction of a trend.

Volume Indicators

Volume indicators, such as On-Balance Volume (OBV) or Accumulation/Distribution, track the volume of trades occurring in the market. High volume often accompanies strong price movements, providing valuable insights for traders.

Moving Average Indicators: Best Indicators For Day Trading

Moving average indicators play a crucial role in day trading as they help traders identify trends and potential entry or exit points in the market. By smoothing out price data over a specific period, moving averages provide a clearer picture of the direction in which an asset’s price is moving.Simple moving averages (SMAs) and exponential moving averages (EMAs) are the two main types of moving averages used in trading.

SMAs give equal weight to each data point in the calculation, while EMAs place more emphasis on recent prices. This means that EMAs react faster to price changes compared to SMAs.

Comparison between Simple Moving Averages and Exponential Moving Averages

- Simple Moving Averages (SMAs) take the average closing price of a security over a specified number of periods, providing a smooth trend line that is slower to react to price changes.

- Exponential Moving Averages (EMAs) give more weight to recent price data, allowing them to react faster to price movements and changes in market sentiment.

- While SMAs are better suited for identifying long-term trends, EMAs are preferred for short-term trading strategies due to their responsiveness to price fluctuations.

Using Moving Averages to Identify Trends

- Moving averages are commonly used to identify trends in the market. When the price is above the moving average, it is considered a bullish signal, indicating an uptrend. Conversely, when the price is below the moving average, it signals a bearish trend.

- Traders often look for crossovers between different moving averages, such as the 50-day and 200-day moving averages, to confirm a change in trend direction and make trading decisions.

- Additionally, the slope of the moving average can indicate the strength of the trend. A steeply sloping moving average suggests a strong trend, while a flat or sideways moving average may indicate a lack of clear direction in the market.

Oscillator Indicators

Oscillator indicators are tools used by day traders to analyze market momentum and identify potential trend reversals. Unlike moving average indicators that follow the trend, oscillators fluctuate within a specific range, providing signals when the market is overbought or oversold.

Role of Oscillators in Day Trading

Oscillators play a crucial role in day trading by helping traders determine when a market is reaching extreme levels. This information can be used to anticipate price reversals and make informed trading decisions.

Commonly Used Oscillator Indicators

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought (above 70) and oversold (below 30) conditions.

- Stochastic Oscillator: The Stochastic Oscillator compares a security’s closing price to its price range over a specific period. It generates signals based on overbought and oversold levels, typically set at 80 and 20.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders look for crossovers and divergences to identify potential buy or sell signals.

Volume Indicators

Volume indicators play a crucial role in day trading as they provide valuable insights into market activity. By analyzing the volume of trades, traders can better understand the strength of price movements and make more informed decisions.

Importance of Volume Indicators

- Volume indicators help traders gauge the level of market participation in a particular asset.

- High volume often confirms the validity of a price trend, indicating strong investor interest.

- Low volume, on the other hand, may suggest a lack of conviction in the current price movement.

How Volume Indicators Confirm Price Trends

- Increasing volume during an uptrend or downtrend can validate the strength of the trend.

- Decreasing volume during a price consolidation phase may signal a potential reversal or lack of momentum.

Interpreting Volume Spikes for Decision-Making

- Traders often look for volume spikes to confirm the breakout of key levels or patterns.

- A sudden surge in volume can indicate a significant shift in market sentiment and potential opportunities for profitable trades.

- However, it is essential to consider other factors, such as price action and support/resistance levels, when interpreting volume spikes to avoid false signals.