Forex trend trading strategies sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset. Dive into the world of Forex trading with a focus on trend analysis and strategic planning.

Introduction to Forex Trend Trading Strategies

When it comes to Forex trading, trend trading strategies are all about riding the waves of price movements in the market. By identifying and following the direction in which a currency pair is moving, traders can capitalize on potential profit opportunities. Let’s dive into some key points about trend trading strategies in Forex.

Popular Trend Trading Strategies

- Breakout Trading: This strategy involves entering a trade when the price breaks through a key level of support or resistance. Traders aim to catch the momentum of the breakout and ride the trend.

- Trend Following: Traders using this strategy follow the direction of the overall trend, whether it’s up or down. They look for opportunities to enter trades in the direction of the prevailing trend.

- Moving Average Crossover: This strategy involves using moving averages to identify changes in the trend. When a shorter-term moving average crosses above a longer-term moving average, it may signal a potential uptrend, and vice versa for a downtrend.

Importance of Trend Analysis

Trend analysis is crucial in devising trading strategies because it helps traders understand the market dynamics and make informed decisions. By identifying trends, traders can adjust their strategies to align with the direction of the market, increasing their chances of success. Trend analysis also allows traders to manage risk more effectively by entering trades that have a higher probability of being profitable.

Types of Trend Trading Strategies

When it comes to trend trading strategies in the forex market, there are various approaches that traders can use to capitalize on price movements. Let’s explore some of the most common types of trend trading strategies and their pros and cons.

Moving Average Crossovers

Moving average crossovers involve using two different moving averages, typically a shorter-term one and a longer-term one. When the shorter-term moving average crosses above the longer-term moving average, it is considered a bullish signal, indicating a potential uptrend. Conversely, when the shorter-term moving average crosses below the longer-term moving average, it is seen as a bearish signal, signaling a possible downtrend.

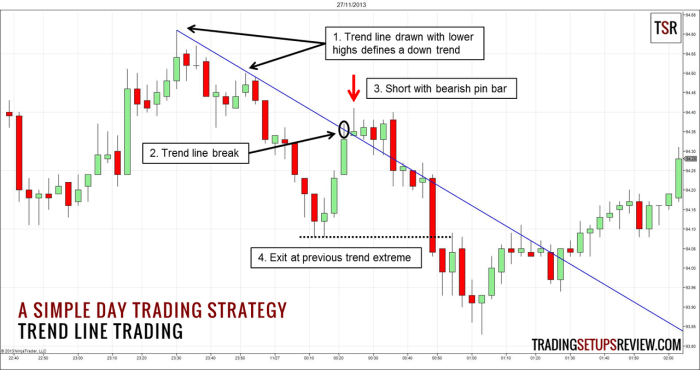

Trendlines

Trendlines are another popular trend trading strategy that involves drawing diagonal lines on a price chart to connect successive highs or lows. Traders can use these trendlines to identify potential entry and exit points based on the direction of the trend. Breakouts above or below trendlines can signal the continuation or reversal of a trend.

Fibonacci Retracements, Forex trend trading strategies

Fibonacci retracements are based on the Fibonacci sequence and are used to identify potential levels of support and resistance in a trending market. Traders can draw Fibonacci retracement levels on a price chart to determine areas where the price may reverse or continue its trend based on these key levels.

Short-term vs. Long-term Trend Trading Strategies

Short-term trend trading strategies typically focus on capturing quick price movements within a shorter time frame, such as intraday or daily trading. These strategies require more active monitoring and quick decision-making. On the other hand, long-term trend trading strategies aim to ride out larger price trends over an extended period, such as weeks or months. These strategies require more patience and a longer-term outlook.

Advantages and Disadvantages

Short-term trend trading strategies can offer the potential for quick profits and more frequent trading opportunities. However, they also come with higher transaction costs and increased risk due to market volatility. Long-term trend trading strategies, on the other hand, can provide more stable returns over time and require less time commitment. But they may also involve holding positions through significant price fluctuations and drawdowns.

Key Components of Effective Trend Trading Strategies

When it comes to successful trend trading strategies, there are key components that traders need to consider in order to maximize their profits and minimize risks.

Essential Components of a Successful Trend Trading Strategy

- Identifying a Strong Trend: One of the most crucial components is being able to identify a strong trend in the market. This involves using technical analysis tools to determine the direction of the trend.

- Entry and Exit Points: Knowing when to enter a trade and when to exit is essential for maximizing profits. This involves setting clear entry and exit points based on your analysis.

- Position Sizing: Proper position sizing is important for managing risk. Traders should determine the amount of capital to risk on each trade based on their overall trading strategy.

- Stop Loss and Take Profit Levels: Setting stop loss and take profit levels helps traders limit their losses and lock in profits. This is crucial for risk management.

Role of Risk Management in Trend Trading Strategies

- Risk management is a critical component of trend trading strategies as it helps traders protect their capital and minimize losses.

- By using stop loss orders and proper position sizing, traders can control their risk exposure and avoid significant drawdowns in their trading accounts.

- Implementing a risk management plan ensures that traders can stay in the game long enough to capitalize on profitable trends and avoid being wiped out by a single losing trade.

Combining Different Technical Indicators for Better Trend Analysis

- Traders can enhance their trend analysis by combining different technical indicators to confirm the strength of a trend.

- Popular technical indicators such as moving averages, MACD, and RSI can be used together to provide a more comprehensive view of the market and validate trading signals.

- By using a combination of indicators, traders can reduce false signals and increase the accuracy of their trend analysis, leading to more profitable trades.

Developing a Forex Trend Trading Plan

When it comes to trend trading in the Forex market, having a well-thought-out trading plan is crucial for success. A trading plan helps traders stay disciplined, organized, and focused on their goals. Here are the steps involved in creating a comprehensive trend trading plan:

Setting Realistic Profit Targets and Stop-loss Levels

Setting realistic profit targets and stop-loss levels is essential in trend trading. It helps traders manage risk and protect their capital. Here are some tips on setting these levels:

- Identify key support and resistance levels to determine profit targets.

- Use technical indicators to set stop-loss levels based on market volatility.

- Avoid setting profit targets too far or stop-loss levels too close to current market prices.

- Regularly review and adjust profit targets and stop-loss levels based on market conditions.

Importance of Backtesting and Refining a Trading Plan

Backtesting is the process of testing a trading strategy using historical data to see how it would have performed in the past. It helps traders identify strengths and weaknesses in their trading plan. Here’s why backtesting is crucial:

- Helps traders understand the effectiveness of their trading strategy.

- Allows traders to refine and optimize their trading plan for better results.

- Provides valuable insights into potential risks and opportunities in the market.

- Enables traders to make data-driven decisions based on historical performance.