With Managing expenses effectively at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

When it comes to managing expenses effectively, it’s all about making smart choices and taking control of your financial future. From understanding different types of expenses to creating a budget and cutting costs, this topic is a must for anyone looking to improve their financial well-being.

Understanding Expenses

Managing expenses effectively starts with understanding the different types of expenses you may encounter in your daily life. By categorizing expenses, you can better track your spending and make informed financial decisions.

Types of Expenses

- Fixed Expenses: These are recurring expenses that remain constant each month. Examples include rent or mortgage payments, insurance premiums, and subscription services.

- Variable Expenses: These expenses can fluctuate month to month and are often discretionary. Examples include groceries, entertainment, and dining out.

Creating a Budget

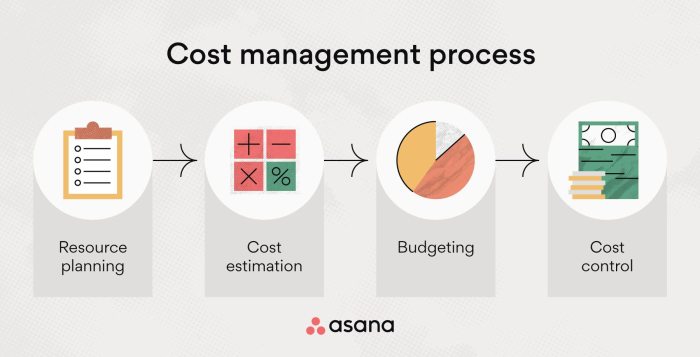

Creating a budget is an essential step in managing expenses effectively. It helps individuals or families allocate their income wisely, prioritize spending, and save for future goals. Here are the steps involved in creating a budget:

Setting Financial Goals

- Start by identifying your financial goals, whether it’s saving for a vacation, paying off debt, or building an emergency fund.

- Set specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your budgeting process.

- Consider short-term, medium-term, and long-term goals to ensure a balanced approach to financial planning.

Tracking Expenses

- Track your expenses for a month to understand where your money is going and identify areas where you can cut back.

- Categorize your expenses into fixed (rent, utilities) and variable (entertainment, dining out) to gain a clearer picture of your spending habits.

- Use apps or spreadsheets to track expenses easily and efficiently, ensuring you stay within your budget limits.

Benefits of Setting Financial Goals Within a Budget

- Helps you prioritize spending on what matters most to you.

- Motivates you to save and invest for the future.

- Provides a roadmap for achieving financial stability and independence.

Cutting Costs

When it comes to managing expenses effectively, cutting costs is a crucial aspect that can help you save money and stay within your budget. By identifying strategies for reducing discretionary spending, understanding the concept of needs versus wants, and learning how to negotiate better deals or discounts, you can take control of your finances and make smarter financial decisions.

Reducing Discretionary Spending

- Avoid impulse purchases by creating a shopping list before going to the store.

- Cut down on eating out and cook meals at home to save money on dining expenses.

- Cancel unused subscriptions or memberships to reduce monthly expenses.

Needs vs. Wants

- Always prioritize essential expenses like rent, utilities, and groceries over non-essential items.

- Identify areas where you can cut back on luxury purchases and focus on meeting your basic needs first.

- Remember that wants are things you desire, while needs are things you cannot live without.

Negotiating Better Deals

- Research prices and compare offers before making a purchase to ensure you are getting the best deal.

- Ask for discounts or promotions when buying products or services to save money.

- Consider negotiating with service providers like cable companies or internet providers to lower your monthly bills.

Saving Money

Saving money is a crucial part of managing expenses effectively. By finding ways to save on regular expenses and setting aside funds for emergencies, you can build financial stability and work towards your long-term financial goals.

Saving on Regular Expenses

- Shop for groceries strategically by making a list before going to the store and sticking to it. Look for sales, use coupons, and consider buying generic brands to save money.

- Reduce utility costs by being mindful of energy consumption. Turn off lights when not in use, unplug electronics, and adjust the thermostat to save on heating and cooling.

Building an Emergency Fund

- Set aside a portion of your income each month specifically for emergencies. Aim to save at least three to six months’ worth of living expenses in case of unexpected events like medical emergencies or job loss.

-

Having an emergency fund can provide peace of mind and prevent you from going into debt when unexpected expenses arise.

Long-Term Saving Strategies

- Save for big-ticket items by setting specific savings goals and creating a separate fund for each item you want to purchase. This can include saving for a new car, home renovation, or vacation.

- Consider investing in retirement accounts like a 401(k) or IRA to save for your future while taking advantage of potential tax benefits and employer contributions.