Diving deep into the world of student loan consolidation, this introduction sets the stage for a journey filled with insights and knowledge. Get ready to explore the ins and outs of this financial process in a way that’s both informative and engaging.

Let’s break down the different types of student loan consolidation and weigh the pros and cons to help you make informed decisions about your financial future.

What is Student Loan Consolidation?

Student loan consolidation is the process of combining multiple student loans into a single loan with one monthly payment. This can help simplify repayment and potentially lower interest rates.

Benefits of Student Loan Consolidation

- Lower Monthly Payments: By consolidating your student loans, you may be able to extend the repayment period, resulting in lower monthly payments.

- Fixed Interest Rate: Consolidation can convert variable interest rates into a fixed rate, providing more stability in payments.

- Simplified Repayment: Managing one loan payment instead of multiple payments can make it easier to keep track of your debt.

How Student Loan Consolidation Works

When you consolidate your student loans, a new loan is created to pay off your existing loans. This new loan usually has a new interest rate and repayment term based on your financial situation. You can consolidate both federal and private loans, but they are typically kept separate.

Types of Student Loan Consolidation

When it comes to student loan consolidation, there are different types available to borrowers based on their specific needs and circumstances. Let’s take a closer look at the various options:

Federal Student Loan Consolidation

Federal student loan consolidation is a program offered by the U.S. Department of Education that allows borrowers to combine multiple federal student loans into a single loan. Here are some key points to consider:

- Available for federal student loans only

- Fixed interest rate based on weighted average of existing loans

- May extend the repayment term, resulting in lower monthly payments

- Eligibility criteria include being in grace period, repayment, or deferment status

Private Student Loan Consolidation

Private student loan consolidation, on the other hand, involves refinancing your existing private student loans through a private lender. Here’s what you need to know:

- Available for private student loans from various lenders

- Interest rate based on creditworthiness and market conditions

- Potential for lower interest rates and monthly payments

- May require a cosigner for approval

Comparing Federal vs. Private Consolidation

Federal student loan consolidation is more structured and offers benefits like income-driven repayment plans and loan forgiveness options. Private consolidation, on the other hand, provides flexibility in terms of interest rates and repayment options.

Eligibility Criteria

To be eligible for federal student loan consolidation, borrowers must have federal loans in grace, repayment, or deferment status. Private student loan consolidation eligibility varies by lender but generally requires a good credit score and income stability.

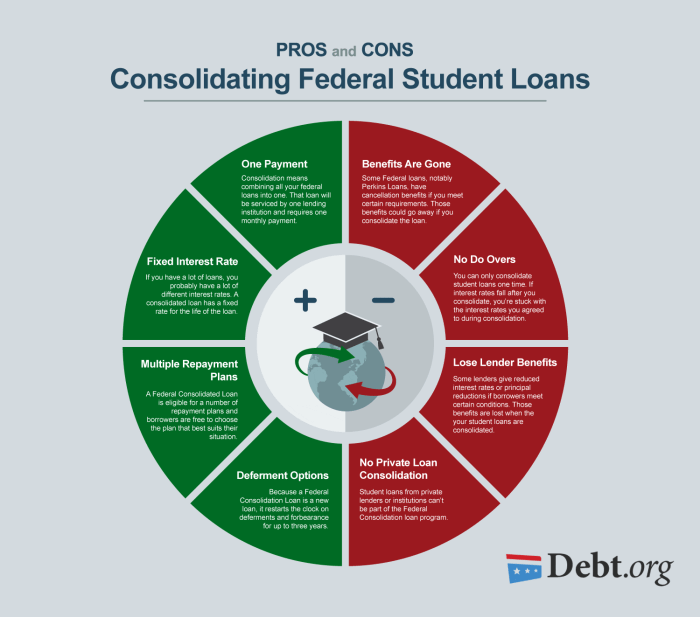

Pros and Cons of Student Loan Consolidation

When considering student loan consolidation, it’s essential to weigh the advantages and disadvantages to make an informed decision about managing your debt effectively. Here’s a breakdown of the pros and cons to help you decide if student loan consolidation is the right choice for you.

Advantages of Student Loan Consolidation

- Streamlined Payments: By consolidating multiple loans into one, you only have to make a single monthly payment, simplifying the repayment process.

- Potential Lower Interest Rate: Consolidation can potentially lower your interest rate, saving you money over the life of the loan.

- Extended Repayment Terms: You may be able to extend the repayment period, reducing your monthly payments and making them more manageable.

- Fixed Interest Rate: Consolidation can convert variable interest rates to a fixed rate, providing stability and predictability in your payments.

Disadvantages of Student Loan Consolidation

- Loss of Benefits: Some federal loans offer borrower benefits like income-driven repayment plans or loan forgiveness, which may be lost when consolidating.

- Potential Higher Total Interest: Extending the repayment term can lead to paying more interest over time, even with a lower interest rate.

- Cancellation of Loan Forgiveness: If you’re pursuing Public Service Loan Forgiveness, consolidating your loans may reset the clock on qualifying payments.

- Limited Options for Private Loans: Private loan consolidation may not offer the same benefits as federal loan consolidation.

Determining If Student Loan Consolidation Is Right for You

Consider your financial goals, current interest rates, loan types, and employment status when deciding on student loan consolidation. It’s crucial to weigh the benefits and drawbacks carefully to ensure that consolidation aligns with your overall financial strategy and long-term objectives.

How to Consolidate Student Loans

Consolidating student loans can help simplify your payments and potentially lower your interest rate. Here is a step-by-step guide on how to consolidate your student loans.

Gather Necessary Documents and Information

Before you start the process of consolidating your student loans, make sure you have all the necessary documents and information ready. This may include:

- Loan account numbers

- Loan servicer contact information

- Income information

- Personal identification

Submit an Application for Student Loan Consolidation

Once you have gathered all the required documents and information, you can proceed to submit an application for student loan consolidation. This can typically be done online through the official government website or through a private lender.

Make sure to carefully review the terms and conditions of the consolidation loan before submitting your application.

Complete the Application Process

After submitting your application, you will need to complete the application process by providing any additional information requested by the lender. This may include signing documents electronically or submitting proof of income.

Be sure to respond promptly to any requests for information to avoid delays in the consolidation process.

Impact of Student Loan Consolidation

When it comes to student loan consolidation, there are several ways it can impact borrowers. Let’s dive into how consolidation can affect credit scores, repayment terms, interest rates, and simplify the loan repayment process.

Credit Score Impact

Consolidating student loans can have a positive impact on a borrower’s credit score. By consolidating multiple loans into one, borrowers may see an improvement in their credit score as long as they make timely payments on the consolidated loan.

Repayment Terms and Interest Rates

One of the key benefits of student loan consolidation is the potential to secure a lower interest rate and extend the repayment term. This can result in lower monthly payments and overall savings on interest costs over the life of the loan. However, it’s essential to carefully review the terms and conditions of the consolidation loan to ensure it aligns with your financial goals.

Simplification of Loan Repayment

Consolidating student loans can streamline the repayment process by combining multiple loans into a single monthly payment. This can make it easier for borrowers to manage their finances and stay on track with their payments. Additionally, having only one loan servicer to deal with can reduce the chances of missing payments or becoming delinquent on the loan.