Understanding Lifetime Customer Value dives deep into the crucial concept of LCV, offering insights on how businesses can leverage this metric for sustainable growth. From calculating LCV to enhancing customer loyalty, this topic covers it all in a way that resonates with the modern business landscape.

Definition of Lifetime Customer Value: Understanding Lifetime Customer Value

In the context of business, Lifetime Customer Value (LCV) refers to the total revenue that a customer is expected to generate for a company throughout their entire relationship. This metric takes into account not only the initial purchase but also the repeat purchases, referrals, and other ways the customer contributes to the company’s revenue over time.

Importance of Understanding LCV

- By understanding LCV, businesses can prioritize customer retention over acquisition, as retaining existing customers is often more cost-effective.

- It helps in determining the marketing budget allocation by focusing on high-LCV customers who are more likely to generate significant revenue.

- LCV provides insights into customer satisfaction and loyalty, allowing businesses to tailor their strategies to improve customer relationships.

Calculation and Use of LCV

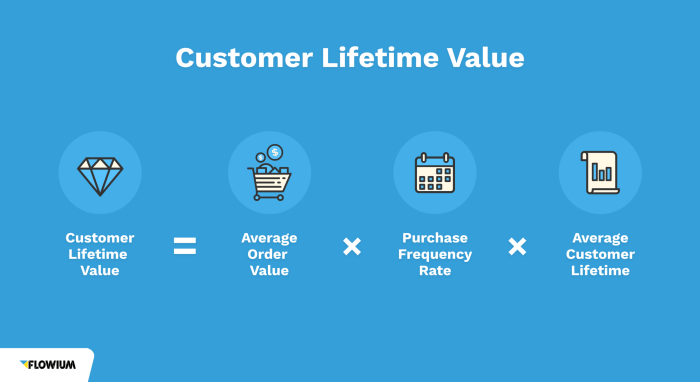

- To calculate LCV, you can use the formula:

LTV = Average Value of a Sale X Number of Repeat Transactions X Average Retention Time

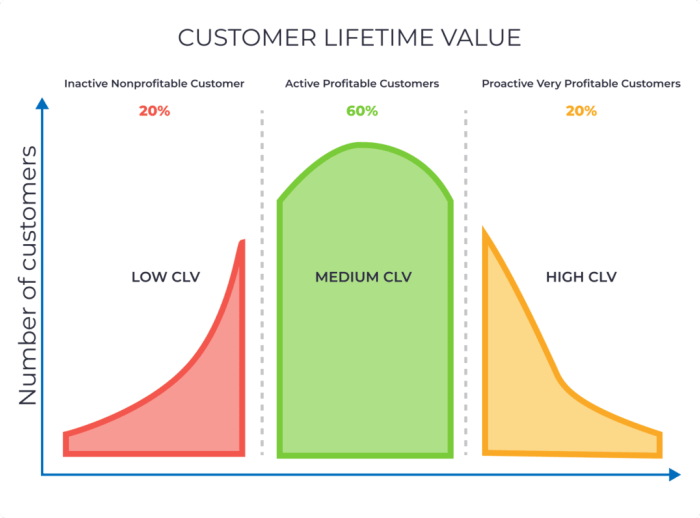

- Businesses use LCV to segment customers based on their value, personalize marketing efforts, set pricing strategies, and improve overall customer experience.

- It helps in predicting future revenue streams, making informed decisions on product development, and enhancing customer service to increase customer lifetime value.

Factors Influencing Lifetime Customer Value

When it comes to determining the Lifetime Customer Value (LCV) of a customer, there are several key factors that come into play. These factors can significantly impact how much a customer is worth to a business over the course of their relationship. Let’s dive into some of the main influencers of LCV.

Customer Behavior

Customer behavior plays a crucial role in determining LCV. How often a customer makes purchases, the types of products or services they buy, and their overall engagement with the brand can all impact their lifetime value. For example, a customer who frequently makes high-value purchases is likely to have a higher LCV compared to a customer who makes infrequent low-value purchases.

Demographics, Understanding Lifetime Customer Value

Demographics such as age, gender, income level, and location can also influence LCV. Different demographic groups may have varying purchasing behaviors and preferences, which can impact how much they contribute to a company’s revenue over time. Understanding the demographics of your customer base can help tailor marketing strategies to maximize LCV.

Purchase History

A customer’s purchase history provides valuable insights into their buying patterns and preferences. By analyzing past purchases, businesses can predict future buying behavior and tailor their offerings to meet customer needs. Repeat purchases and upselling opportunities can significantly increase a customer’s LCV over time.

Customer Satisfaction and Loyalty

Customer satisfaction and loyalty are key determinants of LCV. Satisfied customers are more likely to make repeat purchases, recommend the brand to others, and remain loyal over the long term. Building strong relationships with customers through excellent service, personalized experiences, and loyalty programs can enhance LCV by fostering customer retention and advocacy.

Calculating Lifetime Customer Value

Calculating Lifetime Customer Value (LCV) is crucial for businesses to understand the long-term value of each customer. There are different methods used to determine LCV, each providing valuable insights into customer relationships.

Method 1: Average Revenue Per Customer

One common approach to calculating LCV is by determining the average revenue generated by each customer over their entire relationship with the business. This can be calculated by dividing the total revenue from all customers by the total number of customers.

LCV = Total Revenue / Total Number of Customers

For example, if a business generates $1,000,000 in total revenue from 1,000 customers, the average revenue per customer would be $1,000. This indicates the average value of each customer throughout their relationship with the business.

Method 2: Customer Retention Rate

Another method involves calculating LCV based on the customer retention rate, which is the percentage of customers who continue to do business with the company over time. By multiplying the average revenue per customer by the average customer lifespan, businesses can estimate the total value a customer brings to the company.

LCV = Average Revenue Per Customer x Average Customer Lifespan

For instance, if the average revenue per customer is $1,000 and the average customer lifespan is 5 years, the LCV would be $5,000 per customer over their entire relationship with the business.

Method 3: Discounted Cash Flow

Businesses can also use the discounted cash flow method to calculate LCV, which takes into account the time value of money. This approach considers the future cash flows generated by a customer and discounts them to present value to determine the total value of the customer relationship.

LCV = Σ (Cash Flow / (1 + r)^n)

Where Σ represents the sum of all future cash flows, r is the discount rate, and n is the number of periods. By discounting future cash flows, businesses can obtain a more accurate representation of the LCV.

Strategies to Enhance Lifetime Customer Value

To maximize Lifetime Customer Value (LCV), businesses can implement various strategies that focus on enhancing customer satisfaction, loyalty, and engagement. By fostering strong relationships with customers, companies can increase retention rates and ultimately boost their LCV.

The Importance of Customer Retention in Boosting LCV

Customer retention plays a crucial role in enhancing LCV as it is more cost-effective to retain existing customers than acquire new ones. By providing exceptional customer service, personalized experiences, and loyalty programs, businesses can encourage repeat purchases and long-term relationships with customers. This leads to higher profitability and a sustainable revenue stream over time.

Personalized Marketing and Customer Experience Initiatives

- Utilize customer data to personalize marketing campaigns and offers based on individual preferences and behavior. This tailored approach helps in creating a deeper connection with customers and increasing their lifetime value.

- Implement customer experience initiatives such as proactive customer support, seamless omnichannel experience, and personalized interactions at every touchpoint. By prioritizing customer satisfaction and convenience, businesses can enhance customer loyalty and retention, ultimately improving LCV.

- Invest in loyalty programs that reward customers for their continued support and engagement. By offering exclusive discounts, perks, or personalized rewards, businesses can incentivize customers to remain loyal and increase their lifetime value.